Some Ideas on Unicorn Financial Services You Need To Know

Wiki Article

How Melbourne Broker can Save You Time, Stress, and Money.

Table of Contents9 Simple Techniques For Mortgage Broker In MelbourneNot known Factual Statements About Mortgage Brokers Melbourne Facts About Mortgage Brokers Melbourne RevealedThe 30-Second Trick For Home Loan Broker MelbourneNot known Facts About Loan Broker Melbourne

Brokers can not be paid by you and also by the lending institution, as well as they can not obtain kickbacks from associated companies. A mortgage broker can save buyers time as well as tension by finding and vetting loans as well as taking care of the home loan procedure. Brokers handle documentation, coordinate with appropriate parties as well as keep underwriting on track, which can assist you shut your funding quicker.A home mortgage broker might be able to get unique prices that are reduced than what you might obtain from a lender on your very own. A broker can aid you take care of home mortgage fees by obtaining the loan provider to minimize or waive them, which can conserve hundreds or perhaps hundreds of dollars.

A broker can aid in challenging financial situations, such as a customer with less-than-perfect credit or inconsistent earnings. Brokers are commonly acquainted with loan providers that will certainly deal with ultramodern consumers as well as can assist identify the ideal readily available lendings and rates. A broker can conserve you from errors based on the broker's know-how of the home loan sector.

In the affordable mortgage business, brokers wanting to shut as numerous lendings as quickly feasible may not constantly supply terrific solution. A consumer who fails to research home mortgage brokers might wind up with an error-prone broker that makes homebuying laborious and also difficult. Locating a respectable neighborhood broker may be challenging depending upon where you live.

The 2-Minute Rule for Melbourne Broker

You may wish to use a home loan broker if: You don't have time or perseverance for the home loan application process, or you're in a hurry to protect a home mortgage. You do not have terrific credit rating or you run your very own business, and you are struggling to locate mortgages that will certainly benefit you (https://omnilocallistings.com/mortgage-broker/unicorn-financial-services-springvale-victoria/).

You would certainly such as a broker to assist you waive or reduce your mortgage charges. You would like access to a broker's network of loan providers.

Ask for recommendations from friends, family members or seasoned genuine estate agents; consult with individuals that have actually lately bought houses; and study testimonials. As you are brushing via evaluations, see to it you assess the broker and also not the brokerage firm. "The No. 1 point customers that are buying financings need to do is check out third-party evaluations for the private mastermind," says Jennifer Beeston, branch supervisor and elderly vice president of mortgage lending at Surefire Price, an on-line mortgage lending institution.

Unicorn Financial Services Things To Know Before You Get This

Interviewing brokers can also aid you find the best blend of character, professionalism, responsive communication and trust. It can offer you an excellent concept of the solution quality as well as the circulation of the home mortgage process. Ask just how often the broker closes on time and also exactly how the broker is paid so you can contrast charges and work out."You have to really feel comfy with the home mortgage broker as well as seem like you can tell them anything, due to the fact that in order to have a successful finance, you require to tell them every little thing," Beeston claims. "You don't want a partnership where you feel like they're condescending, or you feel like a problem or a problem, due to the fact that there's so many skilled brokers that would certainly love your service."Doing due diligence before you employ a broker can assist you feel sensibly confident that you've selected someone trustworthy who will connect effectively, worth your company, safeguard your interests and meet deadlines.

If the broker and also the representative don't communicate effectively, cash can be left on the table, claims Elysia Stobbe, writer of "Just how to Get Approved for the Ideal Home Loan Without Sticking a Fork in Your Eye.""Inquire concerns similar to you would certainly when you go to a physician," Stobbe states.

"Simply due to the fact that a home mortgage broker's licensed does not suggest they're proficient at their craft," Stobbe states.

Some Known Details About Mortgage Brokers Melbourne

None people like to think of the reality that we're mosting likely to pass away one day, in spite of the unavoidable reality that the pale horse is coming for all of us (https://vivahdirectory.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). Possibly that's why over fifty percent of us do not have a will.:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)

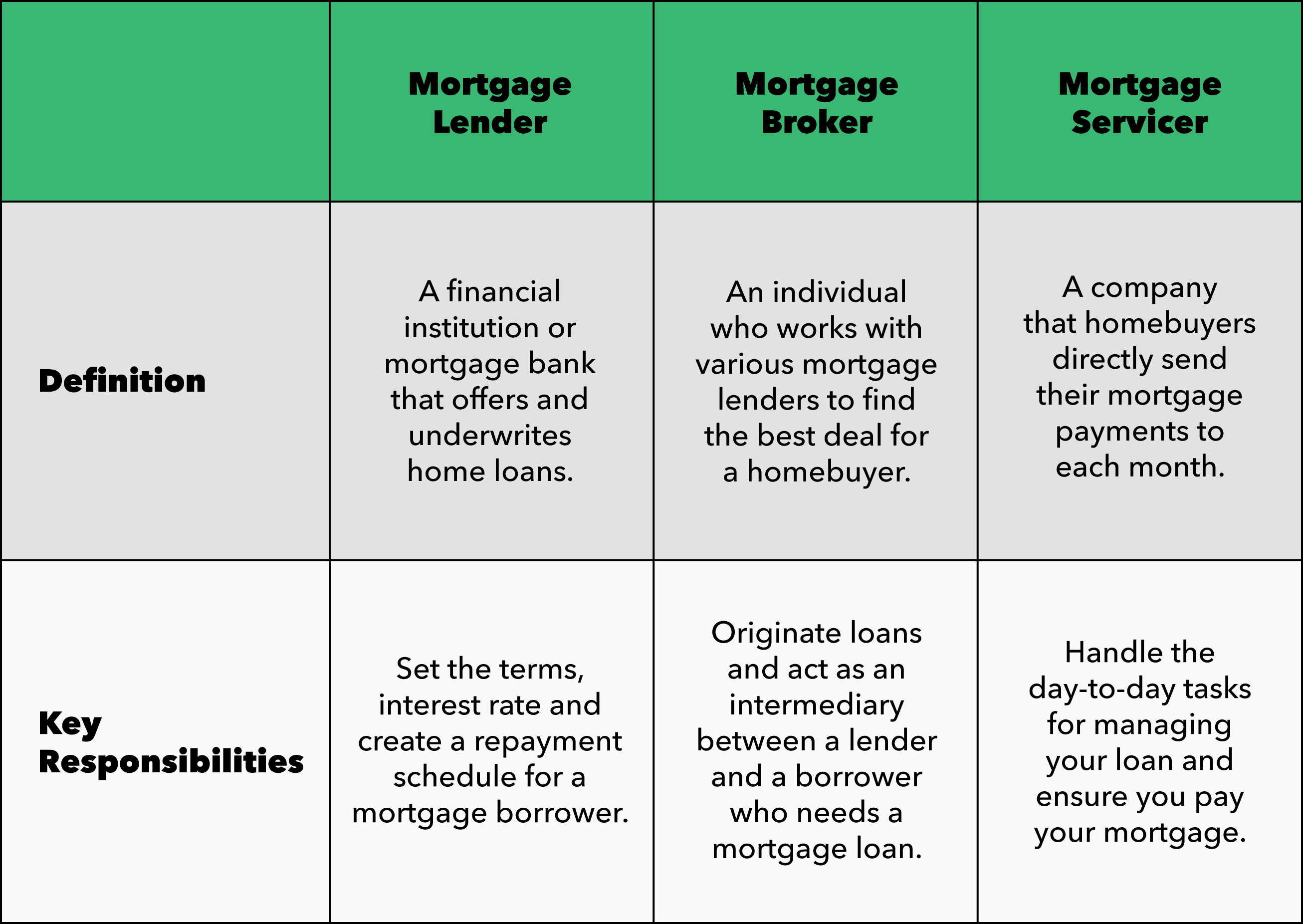

If you work with your local financial institution, you will only have obtaining alternatives provided by that bank. This is a rather narrow scope, considering the various lenders available, but banks won't be using you items from an additional competitor. Making use of a home loan broker provides you access to a larger series of lending institutions.

And also, some lenders just deal with clients introduced to them by a broker, so using a home loan broker can offer you better accessibility to loan find providers. In addition to even more lending institutions comes the potential for safeguarding better products. Normally, the extra alternatives you have, the more probable you are to find your best item match.

Everything about Mortgage Broker Melbourne

Using a home loan broker takes a great deal of that stress away from you. melbourne broker. With a broker, you don't need to bother with browsing the market alone, attempting to find the right spending plan and also a lender to finance your home mortgage. Brokers can help you identify your residence acquiring objectives, and exactly how your earnings as well as costs comprise your budget.Report this wiki page